The video is self-explanatory. This is a cut of an interview with the economist Milton Friedman, which answers a question about what rich people do with the profits they maliciously obtained from the poor citizens of our great nation.

This is an EXCELLENT article addressing the false narrative of the evils of being wealthy~

A picture of the arrogance of wealth.

The wealthy need to pay their fair share. There is no way in the world that the lower classes will ever be able to improve their standard of living if the wealthy people do not help them. The wealthy do not need private jets or personal Yachts while so many people are impoverished. We need the government to take things away from them on behalf of the common good. The market just can’t do it and there is absolutely no proof that a market, without government regulation and high taxes on the wealthy will ever improve the life of the masses.

I had you there for a minute, didn’t I?

It seems these days there is something wrong with being wealthy. You are somehow obligated to pay some arbitrary ‘fair share’ where of course, the majority decides what the ‘fair’ share is.

We seem to forget exactly how wealthy even the lowest of classes are today, compared to the super-elite rich only a hundred years ago.

The automobile used to be an item of luxury. It was the historical Yacht or private jet. You had to be extremely wealthy to be able to afford an automobile. Not just that, but to afford the fuel for it wealthy as well, as gasoline was the equivalent of around $5 a gallon in 1906!

“The ordinary ‘horseless carriage’ is at present a luxury for the wealthy; and although its price will probably fall in the future, it will never, of course, come into as common use as the bicycle.”

-Literary Digest

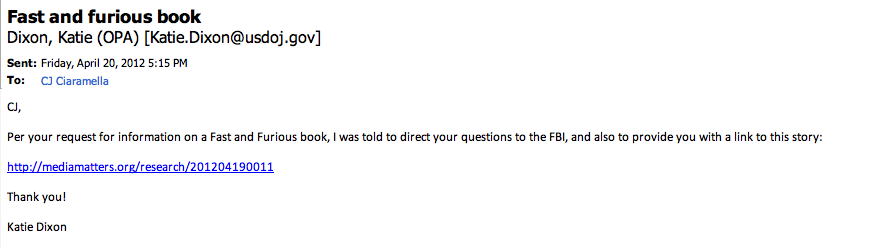

“Nothing has spread socialistic feeling in this country more than the automobile. To the countryman they are a picture of the arrogance of wealth, with all its independence and carelessness.”Today we see the same thing, but instead of it being automobile, it’s simply high end automobiles. Examples such as 500HP Mercedes Benz automobiles which are being called ‘anti-social’ by some government bureaucrats. Don’t forget yachts and private jets. (Never mind all of the middle class people that must be employed for the upkeep of these luxuries).

-Woodrow Wilson, 1906

If we were to fast forward a hundred years, and you saw that the average person had their own private Yacht and private jet, and could easily afford to travel with it anywhere in the world with it, would you consider it to be silly for them to be complaining about people having more higher end Yachts than they do, or more higher end private jets than they do?

Of course you would.

The free enterprise system has a natural redistribution of wealth. When the wealthy purchase new products at exorbitant costs, it allows the producers of these goods to re-invest the profits into increasing production, resulting in lower prices and more advanced products as they improve on their designs.

Today you can buy a new car for $15,000 that is far superior, faster, safer, and with more features than an automobile in 1906 that would have cost a very rich man the equivalent of $200,000 brand new. In fact, for $15,000 you can buy an automobile that a rich man could not buy at any price at all in 1906, because it simply didn’t exist.

This same rule applies for most everything. For example, look at the computer industry. Today you can buy a computer for a thousand dollars that has more processing power than computers that used to cost tens of millions of dollars only a few decades ago.

A cell phone used to cost you the equivalent of $9,000, had monthly charges about the size of a mortgage payment. Yet despite costing the equivalent of $9,000, they didn’t even have a camera. Today you can get a cell phone with an assortment of features for a measly $200, even as low as $50 if you want something a little older that still beats the pants off the first cell phones.

You didn’t need government bureaucrats or government regulation of the industry in order to accomplish this. It was done automatically by the market. So, rather than everybody making more money, the purchasing power of their wages increases instead.

These are what we can call “real wages”. You can buy more products and services with your income than you used to be able to, you are therefore, wealthier as a result.

And this was all accomplished simply because of the profit motive. Things actually get cheaper when people are pursuing profits.

Read More: Collateral Damage